Types Of Real Estate Investment In Malaysia

Property investment is like playing a game of Monopoly, but with real money and actual properties instead of colorful fake ones. It's the art of strategically buying and owning properties to make your bank account go cha-ching ! You become the proud owner of houses, apartments, or maybe even a fancy mansion if you hit the jackpot. But remember, it's not just about collecting properties, it's about making smart decisions and staying one step ahead of the market.

Define Real Estate Investment

Property investment in Malaysia refers to the act of purchasing real estate with the intention of generating income and/or capital appreciation. It involves acquiring properties such as residential homes, commercial buildings, or land for the purpose of renting, leasing, or selling them for a profit.

Property investment in Malaysia is a popular form of investment due to the country's vibrant real estate market and strong economic growth. Investors may choose to invest in various types of properties, including residential properties for rental income, commercial properties for leasing to businesses, or land for development purposes.

Investors can benefit from property investment in Malaysia through several avenues. Rental income from tenants can provide a steady cash flow, while property value appreciation over time can lead to capital gains. Additionally, property investment can serve as a hedge against inflation and provide diversification within an investment portfolio.

Investors in property should consider factors such as location, market trends, potential rental demand, financing options, and the overall economic outlook when making investment decisions. Conducting thorough research, seeking professional advice, and assessing risks are essential steps in successful property investment in Malaysia.

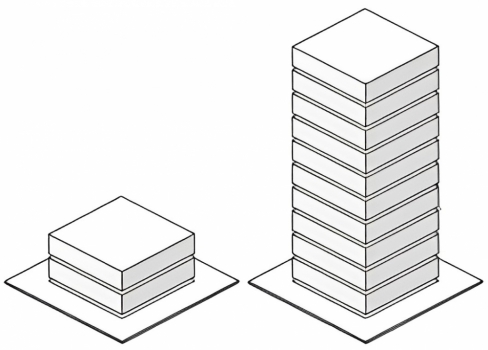

What Are The Types Of Real Estate Investment ?

![]()

1.) Residential Investments:

Residential investments refer to investments made in properties with residential land titles, including terrace houses, apartments, and condominiums. There is an exception for certain commercial land-titled properties protected under the Housing Development Act (HDA), such as SoHo developments.

The location of the property plays a significant role in its monetary returns, as properties in high-demand or preferred areas yield better rental income and sale prices. However, owners are responsible for covering all property-related bills and maintenance costs, which can be burdensome if rental income falls short of expenses.

2.) Commercial Investments:

Commercial investments involve properties with commercial land titles, such as office buildings, SOVOs, SOFOs, and shop lots. These properties are primarily used for business purposes and are typically leased to companies and small business owners.

Commercial properties often involve long-term leases, providing a stable cash flow even during market fluctuations. Investing in commercial properties requires higher upfront capital, with lower margin of financing compared to residential properties. The success of commercial investments depends on factors like occupancy rates, surrounding township occupancy, public transportation efficiency, and building maintenance.

Unlike residential properties, tenants usually bear costs such as utility fees. Additionally, commercial units are often rented out unfurnished, reducing costs for the property owner.

3.) Retail Investments:

Retail property investments involve properties located in malls and other retail storefronts. Landlords often receive a base rent along with a percentage of the tenant's profits to maintain the property.

This type of investment combines both property and business investments.

4.) Industrial Investments:

Industrial real estate investments encompass various properties such as warehouses, distribution centers, and storage units. These investments generate income from rentals or resale, and often include additional revenue streams such as fees and services.

Industrial investments require specialized professionals and larger upfront capital, and are considered riskier compared to residential and commercial investments.

5.) Real Estate Investment Trusts (REITs):

REITs offer an affordable and accessible way to invest in real estate. By purchasing shares in a corporation that owns real estate properties, investors can receive dividend income. REITs allow investors to focus on specific industries, such as hotels or commercial properties. However, investors do not have ownership or decision-making power over the properties, and obtaining financing for REIT investments can be challenging.

REITs are viewed similar to common stocks.

Final Verdict

Property investment can be a lucrative venture for individuals seeking income generation and long-term capital appreciation. It offers various opportunities for diversification, potential rental income, and potential tax benefits. However, like any investment, it carries certain risks and considerations.

Property investment requires a long-term perspective as it may take time to realize substantial returns. It is important to assess one's financial goals, risk tolerance, and time horizon before committing to property investment.

Furthermore, property investment may require active management, especially for rental properties, including tenant selection, property maintenance, and dealing with legal and regulatory obligations. Engaging professional assistance, such as property agents, can help streamline the investment process.

Overall, property investment can be a rewarding and profitable endeavor, especially when approached with proper planning, research, and a long-term perspective. However, it is important to weigh the potential benefits against the associated risks and individual financial circumstances before making any investment decisions.