Overnight Policy Rate, Why You Should Know About It

The Overnight Policy Rate (OPR) is a crucial element in Malaysia's monetary policy framework. Managed by the central bank, Bank Negara Malaysia, the OPR plays a significant role in influencing interest rates and shaping the country's economic landscape. As a property investor, homeowner, or industry observer, understanding the OPR and its impact on the property market is essential. In this article, we delve into the significance of the OPR, its recent trends, and how it affects property prices, mortgage rates, and investment decisions.

So What Is OPR ?

The OPR, or Overnight Policy Rate, is a rate carefully nurtured by our central bank, Bank Negara Malaysia (BNM). It's like a matchmaking service for financial institutions, determining the interest rate they charge each other when lending money overnight.

Picture this: Banks, just like humans, have their own ups and downs in terms of cash reserves. It's like a financial rollercoaster ride, depending on their lending activities, customer deposits, and withdrawals. Sometimes they're swimming in cash, other times they're searching under the couch cushions for spare change.

To keep the financial ecosystem in balance, BNM steps in with the OPR. Think of it as a referee blowing the whistle and saying, "Hey, you financial institutions, this is the rate you should charge each other for those overnight money flings."

So, you see, the OPR is like a financial matchmaker, ensuring that banks can always find a willing partner to borrow money from when they're in need, keeping the cash flow steady and the financial world spinning. And just like in the world of dating, the OPR can change its mind from time to time, depending on the economic climate and the whims of BNM.

In a nutshell, Overnight Policy Rate (OPR) is set and controlled by Bank Negara Malaysia (BNM) to determine the rate of interest for financial institutions that lend each other money overnight.

So Why Is It Important ?

The Overnight Policy Rate (OPR) in Malaysia has a significant impact on the housing sector, influencing various aspects such as mortgage rates, property demand, affordability, and overall market dynamics. Here are a few examples of how the OPR affects the housing sector:

-

Mortgage Rates: Changes in the OPR directly influence lending rates offered by financial institutions, including mortgage rates. When the OPR is lowered by Bank Negara Malaysia (BNM), banks tend to reduce their lending rates, resulting in lower mortgage costs. This makes housing loans more affordable and stimulates demand in the housing sector. Conversely, an increase in the OPR can lead to higher mortgage rates, potentially affecting affordability and dampening demand.

-

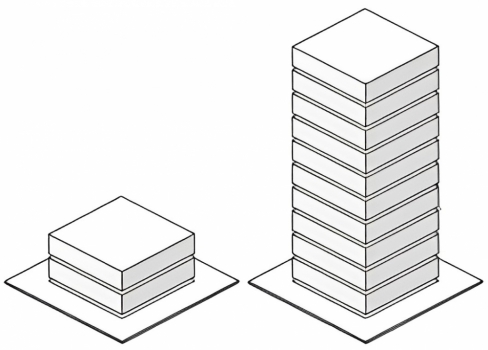

Property Demand: The OPR plays a crucial role in shaping property demand. Lower interest rates due to a low OPR incentivize individuals to enter the property market, as borrowing costs are reduced. This can lead to increased demand for housing, driving up property prices in certain areas. Conversely, a higher OPR may reduce affordability, leading to decreased demand and potentially slowing down property price growth.

-

Investor Confidence: The OPR also influences investor confidence in the housing sector. When the OPR is low, it creates a favorable environment for property investment, as borrowing costs decrease and potential returns on investment improve. Investors may take advantage of lower interest rates to acquire properties for rental income or capital appreciation. However, if the OPR increases significantly, it may affect investor sentiment and their willingness to invest in the housing market.

-

Market Stability: The OPR serves as a tool for BNM to manage economic stability, including the housing sector. By adjusting the OPR, BNM can influence credit availability and liquidity in the market. This helps maintain a stable and sustainable housing market by managing inflation, controlling speculative activities, and ensuring a balanced supply and demand scenario.

-

Market Sentiment and Timing: The OPR announcements by BNM create market sentiment and influence the timing of property purchases. Prospective homebuyers often track the OPR movements to determine the right time to secure a mortgage. A lower OPR may encourage individuals to enter the market, while a higher OPR may prompt them to wait for a more favorable interest rate environment.

If you find yourself unsure, it is advisable to consult with the home loan advisors at your bank or seek assistance from a licensed independent financial advisor who specializes in providing guidance on financial planning. Their expertise can help you navigate through the complexities of property purchasing and make informed decisions that suit your needs.

Remember, the more knowledge you possess about the property market, the more confident you will be in finding the perfect deal that aligns with your requirements.