Online "shopping" for houses a hot trend given the ongoing pandemic

Online "shopping" remains a hot trend for those who are looking to purchase a residential unit, either landed or high-rise, amid the ongoing Covid-19 pandemic

Further, the ongoing initiative by the government and incentives given by property developers is encouraging potential home seekers to buy a property now instead of spending their money elsewhere.

There are several government initiatives to support Malaysians, including full stamp duty exemptions for those who are purchasing their first home, priced up to RM500,000 and it is valid until December 31, 2025.

The continuation of the Real Property Gains Tax exemption for Malaysian owners who dispose of their residential property until December 31, 2021, will for certain incentivise sellers to dispose of their properties at attractive prices.

Furthermore, Bank Negara's efforts to lower the overnight policy rate to 1.75 per cent also effectively reduces interest rates for homes to three per cent. This gives buyers an opportunity to not only secure a property at an attractive price but with the added benefit of a lower interest rate and monthly repayment.

Developers on the other hand are further adding value by offering rebates, discounts, free legal fees, and other freebies to entice buyers.

The rise of the Covid-19 cases and the implementation of variations of the Movement Control Order has led to uncertainty for all Malaysians.

While there are several negative impacts of the Covid-19, the virus has made Malaysians more aware of the need to save up for rainy days and relook their financial plans.

One thing is for sure, that more people are now putting their money in more than one basket. Apart from the various investment and financial tools available in the market, the investing community has property high on its list.

According to findings from a recent survey carried out by InsightzClub, most Malaysians remain optimistic about the economic situation after Covid-19.

InsightzClub is a new-age consumer insights firm that helps consumer brands to obtain intelligent insights to make data-driven decisions. Entitled Project BREW, the survey involved over 600 participants aged 21 and above, focusing on consumers who browse, buy and sell from online platforms.

The survey highlighted that 70 per cent of respondents are looking to generate wealth via investments, with 41 per cent of consumers opting for property investments.

Furthermore, the survey showed that respondents aged between 24 and 35 years old were the main buyers and sellers of properties.

Findings also indicate that overall property sellers were skewed towards those with a higher household income of RM8,000 and above.

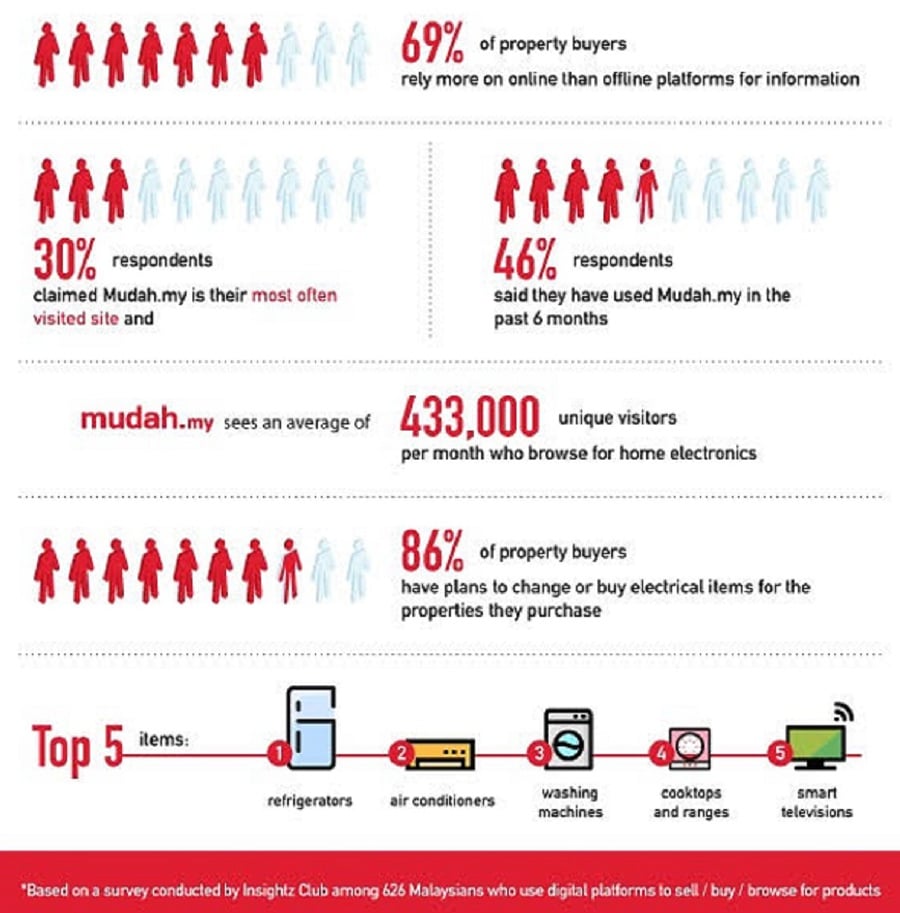

The survey indicated that 69 per cent of property buyers rely more on online platforms than offline ones, with Mudah.my being the top choice for property buying and selling.

This is in line with Malaysia's largest marketplace having over 8,000 listings for new properties below RM500,000 across the country, said Mudah.my head of marketing, Andrew Pinto

"The pandemic has done no favours for the economy. However, there is hope. Malaysian consumers remain relatively optimistic about the economic recovery post-Covid-19 and are looking to boost their investment portfolios," he said.

Pinto said Mudah.my is always looking for opportunities to help equip consumers with the right tools and knowledge to make better purchasing decisions.

The survey also tapped into the behaviours of new homeowners. It revealed that most property buyers intend to purchase new electronic items such as refrigerators, air conditioners, washing machines, air fryers, water purifiers, microwaves, and dryers for their new home.

"The buying and selling of properties are seen as a great way to stimulate the economy. The importance of online marketplaces once again shows that more than 70 per cent of consumers rely on online platforms for information," Pinto said.

Pinto said, as a result, Project BREW has shown that Malaysian consumers remain optimistic about the economic recovery, post-pandemic.