MRTA Or MLTA ? What Is Mortgage Insurance In General ?

Are you dreaming of owning a home but worried about life's unexpected curveballs? In the unfortunate event of your demise or a permanent illness, have you ever wondered what would become of your home and family?

Mortgage insurance is like the superhero cape your home loan wears to protect you and your loved ones. It's not just important; it's the safety net that ensures your family's financial stability, even in the face of unforeseen events like death or permanent illness. With mortgage insurance by your side, you can rest easy knowing that your home will remain a haven for your loved ones, no matter what life throws their way.

Mortgage Reducing Term Assurance (MRTA) and Mortgage Level Term Assurance (MLTA) are terms we often come across when discussing mortgage insurance. But what do they actually entail, and why are they so important? In this article, we will delve into the essential aspects of having a mortgage insurance policy.

Mortgage Reducing Term Assurance (MRTA)

Mortgage Reducing Term Assurance (MRTA) is a popular and cost-effective choice for people taking out a home loan. It's usually offered by banks as an option when applying for a housing loan. MRTA is a type of life insurance that covers your outstanding home loan in case of your death or total permanent disability (TPD).

When applying for MRTA, you can choose the coverage amount and policy duration, and the premium you'll be charged depends on factors like your age and gender. The premium is typically paid upfront as a lump sum. Many homebuyers add this premium amount to their mortgage value, as banks often offer a lower interest rate on the home loan if MRTA is chosen.

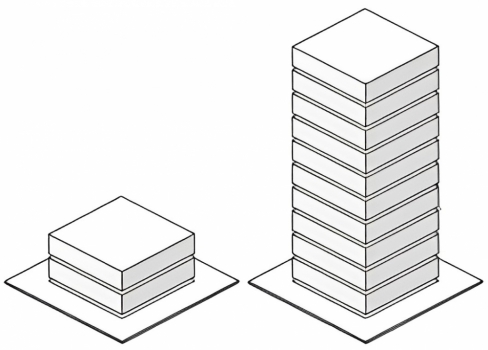

The coverage amount of MRTA gradually decreases along with your outstanding loan balance over time. When the loan tenure ends, the coverage amount reaches zero. If you were to pass away or become permanently disabled, the insurance benefits would be directly paid to the bank to settle your outstanding loan. Your family members would not receive any cash benefit from it because the bank is the beneficiary of the MRTA policy.

While it's possible to buy MRTA later, you'd need to have enough money to pay the lump sum premium on your own. This can create unnecessary debt for your family if something were to happen to you, adding to their already challenging situation.

Pros of MRTA:

1. Lower total premium cost compared to MLTA. Requires only a single lump sum payment.

2. Can be conveniently bundled with your housing loan, reducing additional cash expenses.

Cons of MRTA:

1. Limited coverage for death and Total Permanent Disability (TPD) only. No payout for critical illness.

2. The sum insured decreases over time and reaches zero at the end of the loan tenure.

3. Transferring MRTA to a new property can be a complex process.

1U Note: Banks often encourage the adoption of MRTA because they benefit from being the policy's beneficiary. While banks may strongly recommend MRTA, it's important to understand that purchasing this mortgage insurance is not mandatory. So, if your lender insists on it as a requirement for obtaining a home loan, remember that you have the freedom to explore other options without feeling obligated to purchase MRTA.

Mortgage Level Term Assurance (MLTA)

Mortgage Level Term Assurance (MLTA) differs from MRTA in several ways. With MLTA, the payout is applied to the outstanding home loan, and the assured amount remains consistent over time. Unlike MRTA, where the lender is the beneficiary, MLTA allows your chosen beneficiary to receive the cash value in addition to the loan coverage.

MLTA functions as a regular life insurance policy, requiring regular premium payments that are not deductible from your mortgage. It's essential to thoroughly understand the terms and conditions of MLTA before making a decision. This type of insurance offers repayment of your outstanding home loan and guarantees a cash value at the end of the policy. This cash benefit can provide crucial financial support for your family in the event of your death or total permanent disability (TPD). Unlike MRTA, MLTA allows you to nominate any family member as the beneficiary.

MLTA provides consistent coverage throughout the policy's tenure and offers additional savings and optional riders. One significant advantage of MLTA is that the insurance proceeds are credit-proof and not subject to freezing. Some MLTA policies even provide returns on premiums to meet your family's financial needs.

Pros of MLTA:

1. Consistent protection throughout the tenure.

2. Accumulation of cash value that can be withdrawn if needed.

3. Easy transfer of protection to a new property purchase.

Cons of MLTA:

1. Higher total premium cost compared to MRTA.

1U Note: MLTA is not sold by banks but is typically offered by mortgage loan brokers or insurance agents.

Differences Between MRTA & MLTA

Here are the major differences between MRTA and MLTA:

| Aspect | MRTA | MLTA |

|---|---|---|

| Purpose | For protection purposes | For protection, savings, and/or cash value purposes |

| Payout Beneficiary | To the mortgage lender | To any nominated beneficiary |

| Premium | The premium is lower | The premium is higher |

| Financing agreement | You will need to pay a lump sum either in cash or financed into a housing loan | You can have the option to pay periodic payments throughout the term |

| Cash Value | MRTA will not have cash value because it will reduce the cash value until the end of your loan tenure | Unlike MRTA, MLTA has a fixed cash value (guaranteed) throughout the loan tenure |

| Transferability | No | Yes |

| Nomination | Bank will act as the beneficiary | Anyone that you choose can be the beneficiary |

Conclusion

When purchasing a new home, mortgage officers often recommend mortgage life insurance like MRTA or MLTA. However, it's crucial to conduct thorough research before committing to any insurance policy.

Mortgage life insurance aims to provide security for your loved ones by covering home loan repayments in the event of your death or permanent disability. If you don't have anyone to leave your property to or have financial constraints, mortgage life insurance may not be a top priority. However, for individuals with dependents, it's worth considering.

Without MRTA or MLTA, you risk potential consequences. If you plan to pay off your mortgage within a few years, mortgage life insurance may not be a priority. However, if you anticipate servicing the loan for a longer period, especially if you are co-purchasing with someone else, having protection is essential.

For instance, if you and your spouse are purchasing a property and sharing the repayment responsibility equally, the loss of one person's income due to death or permanent disability could have significant financial implications. Mortgage life insurance provides peace of mind, ensuring that you won't lose your property even if the other person is unable to fulfill their mortgage obligations.