Why Is Property Valuation Essential When Buying A Property ?

When you are buying a property in the subsale market, your bank will access your loan options and go through the necessary procedure to approve your loan. When you are going to buy a property, the market value is the estimated amount of the property that you and the seller have agreed upon. In clear definition, it is 'the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion.' in accordance to Malaysian Valuation Standards Sixth Edition 2019.

However, the bank requires a professional and registered valuer to ascertain the market value in order to offer the loan to the customer, or in this case, the buyer.

The property valuation is carried out by a firm recognized by the bank from which you are seeking a loan. This valuation process considers recent transaction prices obtained from the government's Valuations and Property Services Department (JPPH). These valuation firms are registered with the Malaysian Board of Valuers, Appraisers, Estate Agents, and Property Managers (BOVAEP) and are authorized to assess property values based on market evidence. Some larger banks also have their own in-house valuation units.

It is crucial to note that the bank will provide a loan amount equivalent to 90% of the property's valuation, not the agreed-upon price between the buyer and seller.

1U Note: Property valuation services are not needed when purchasing a new project, as that is already been done in between the bank (end-financier) and the property developer.

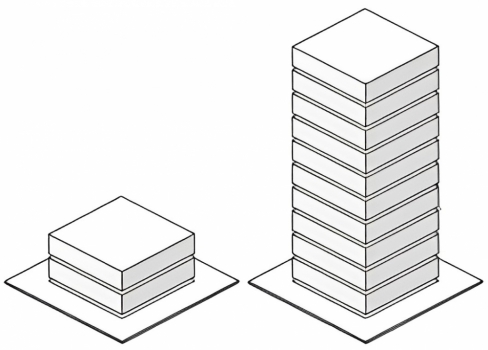

Standard Procedure Of Property Valuation

![]()

The property valuation plays a vital role in the bank's loan application process, as demonstrated by the following steps:

Step 1: The buyer applies for a property loan with their preferred bank.

Step 2: The bank enlists the services of a trusted valuation expert to evaluate the property, in this case, the bank will enquire the services of a valuation firm within its empanelment.

Step 3: The valuer examines recently transacted values of neighboring properties using information from JPPH, or any other valuation methodology required for the subject property.

Step 4: The valuer conducts a physical inspection of the subject property, in which the valuer will access its floor plan(s) and analyse the nearby surroundings and amenities of the subject property.

Step 5: Based on the data, the valuer prepares a comprehensive valuation report for the bank depending on the purpose of the valuation.

Step 6: The bank approves the loan amount, which is typically 90% of the value determined by the valuer, subject to the borrower's financial standing.

What Determines The Factors To Find Out The Market Value Of A Property ?

In Malaysia, valuation firms typically base their property valuations on a combination of data from JPPH and other relevant factors. Here are a few examples of factors considered to determine the market value:

A.) Location - A prime location will increase the market value of the property.

B.) Tenure - Freehold properties generally have higher market value, while leasehold properties tend to be valued lower.

C.) Amenities - Properties with a greater number of nearby amenities command higher market value.

Valuers also take into account factors like building depreciation, additional adjustments, and the relationship between land area and building value to make a well-rounded assessment of the property's market value.

So alas, you get the loan you needed, and the valuer will have finished his task to ascertain the market value of the subject property.

If you are looking for any registered valuation companies in Malaysia, there are some to name a few: Rahim & Co, The One Valuers International Sdn Bhd, Knight Frank Malaysia, CBRE | WTW and more. It is good advise to consult them to understand your house a little better.