Property Refinancing 101: What Is It, And How Do You Do It ?

Property refinancing refers to the process of replacing an existing mortgage or loan on a property with a new loan that has different terms and conditions. It typically involves obtaining a new loan from a different lender (bank) or renegotiating the terms with the existing lender.

There are several reasons why property refinancing is important:

-

Lower Interest Rates: One of the primary reasons for refinancing is to take advantage of lower interest rates. If interest rates have decreased since you initially obtained your mortgage, refinancing allows you to secure a new loan at a lower rate, potentially reducing your monthly mortgage payments and overall interest costs.

-

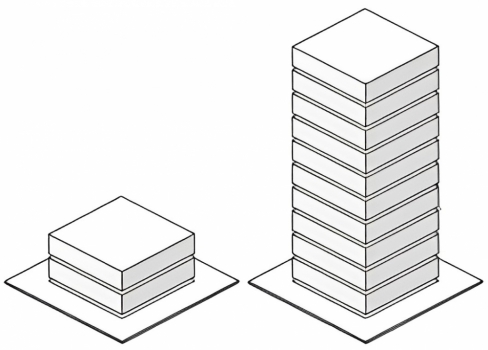

Access to Equity: Refinancing can provide homeowners with access to the equity they have built up in their property. By refinancing, they can borrow against the equity and use the funds for various purposes such as home renovations, debt consolidation, or other financial needs.

-

Debt Consolidation: Refinancing can be an effective strategy for consolidating multiple debts into a single loan. By refinancing, you can pay off high-interest debts such as credit card balances or personal loans and consolidate them into a mortgage with a lower interest rate. This can simplify your financial obligations and potentially save you money on interest payments.

-

Home Equity Conversion: Homeowners who are older and have significant home equity may consider refinancing through a reverse mortgage or home equity conversion mortgage (HECM). This allows them to convert a portion of their home equity into funds that can be used for retirement income or other financial needs.

So You Want To Refinance Your Property, But Do Not Know How

![]()

Refinancing your mortgage is quite similar to applying for a new loan, but with a touch of mortgage déjà vu. So, here's the step-by-step process:

1. Take a Peek at Your Current Mortgage

Check if your mortgage is still within its lock-in period. Think of it as checking if your favorite pair of socks is still in style.

1U NOTE -- What is lock-in period ?

The lock-in period is a specific duration during which you are bound to keep your home loan with a particular bank. Typically lasting between 3 to 5 years, this means that within this period, your home loan account must remain active and cannot be closed, refinanced, or sold without incurring a penalty.

If you decide to proceed with closing the home loan account before the lock-in period ends, whether through refinancing, selling the property, or settling the loan with your own funds, the bank will impose a penalty. The penalty rate can vary across different banks, but a common penalty is 3% of the original loan amount.

For instance, if the original loan amount is RM 500,000, the penalty would amount to RM 15,000. This penalty fee is then added to your outstanding loan amount. For example, if the outstanding loan amount is RM 450,000, after adding the RM 15,000 penalty, the total amount that needs to be settled would be RM 465,000.

It is important to carefully consider the lock-in period and any associated penalties when contemplating refinancing or early closure of your home loan account to make an informed financial decision.

2. Dial-a-Bank

Contact a few banks and let them woo you with their irresistible deals. It's like speed dating, but instead of finding your soulmate, you're hunting for the best mortgage terms. ELR (Effective Lending Rate), moving costs, and lock-in periods become your criteria for a dreamy match.

3. Put on Your Negotiation Hat and Bargain for a Sweeter ELR if You're Not Desperate for Cash

Then, play the ultimate game of offer comparison between the banks, analyzing every tiny detail to find your perfect match.

4. Once You've Found "The One," Seal the Deal and Bask in the Glory of Its Perks !

Remember, property refinancing is serious business. So, go forth, negotiate like a pro, choose wisely, and embrace the benefits that come with finding your ideal refinancing solution !