Property Joint Purchase: What You Should Know

Welcome to the world of property joint purchase in Malaysia, where dreams of owning a home become a shared reality !

Imagine a unique journey where friends, family, or even like-minded investors come together, pooling their financial strengths and forging unbreakable bonds in pursuit of a common goal: acquiring a property that surpasses expectations. This progressive approach not only empowers people to achieve their property dreams sooner but also fosters a sense of community and camaraderie that lasts a lifetime.

As young Malaysians embark on the journey of marriage and settling down, the idea of purchasing a property, either for personal use or as an investment opportunity, gains significant traction. With the potential to rent out or sell the property in the future for profitable returns, many are now seriously considering joint purchase property as a compelling and viable option, especially for first-time buyers.

However, delving into the realm of joint purchase property is not without its challenges and risks. While it offers an attractive solution, navigating this path requires careful consideration and understanding of the potential pitfalls involved. Let's explore this topic further and delve into the intricacies of joint purchase property to better comprehend its benefits and drawbacks.

The Advantages Of Joint Purchase Of A Property

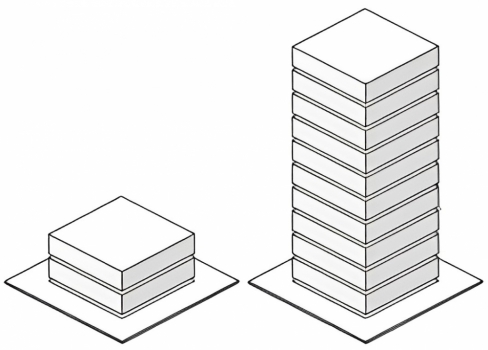

A joint home loan considers the combined income of the applicants, which can lead to several tangible advantages. By pooling their incomes, individuals can access a higher total loan amount, surpassing what they might have qualified for individually based on their income levels. This increased purchasing power not only opens doors to larger loan approvals but also enhances the likelihood of approval for a more manageable loan amount.

With the combined income exceeding the bank's threshold, applicants stand a better chance of securing approval for their desired loan. Additionally, sharing the incidental costs associated with purchasing a house, such as taxes, downpayment, and fees, becomes easier when shared with a partner.

Furthermore, the joint income contributes to a higher loan approval rate (depending on who are the parties in the property joint purchase, such as: couples, friends, investors, family members, etc, so do be aware), offering greater financial security and potential opportunities for aspiring homeowners.

In the context of a joint home loan, applicants also benefit from shared entrance and purchase costs. When multiple individuals come together to apply for a home loan, they collectively bear the expenses involved in entering into the loan agreement and acquiring the property. This shared financial responsibility can make the overall process more affordable and manageable for all parties involved. By combining resources, the burden of entrance fees, processing fees, and other costs related to the loan application and property purchase can be distributed among the applicants, making homeownership a more accessible and practical venture.

The Disadvantages Of Joint Purchase Of A Property

The joint home loan scenario may also result in some disadvantages, such as potentially losing access to certain first-time buyer initiatives and missing out on potential RPGT (Real Property Gains Tax) exemptions.

Additionally, non-family loans in a joint application may undergo more stringent assessment, which can present challenges during the loan approval process. It highlights the importance of ensuring that all joint applicants maintain a positive credit history to enhance the likelihood of securing the desired home loan successfully.

In the context of a joint home loan, conducting a credit check (CCRIS or CTOS) becomes even more crucial as it involves assessing the credit records of all applicants. With multiple individuals applying for the loan, their credit histories are carefully evaluated, and the presence of a poor credit record from any joint applicant can negatively impact the overall approval chances, regardless of the other applicants' clean records.

Case Scenario

Enough with the theory, let's move on to some case scenarios as so to allow you to grasp the idea of joint purchase of a property !

Introducing Adam and Eve, a married couple looking for a single-storey terraced house within Subang Jaya, Selangor.

A.) Suppose Adam and Eve, as first-time property buyers in Malaysia, decide to purchase a property. They must be prepared to cover the downpayment of the property and any renovation/refurbishment cost that will be incurred onto the property.

If Adam chooses to buy the residence solely and encounters difficulties in servicing the mortgage over time, his credit score alone will be affected.

On the other hand, if Adam and Eve opt for a joint mortgage to purchase the property and encounter challenges with repayments, both of their credit scores will be impacted. In such a scenario, they need to be aware that one of them will have to compensate for any payment shortfall if the other is unable to meet their installment obligations.

Thus, it becomes essential for couples like Adam and Eve to carefully consider whether they both want to take on the responsibility of servicing the mortgage and be fully prepared for the financial commitment involved.

B.) In an investment venture, Adam and Eve joined forces to purchase a property and obtained a home loan from a local bank. Unfortunately, one of the co-owners, Adam, encountered financial difficulties and fell into debt. As a result, the bank had the right to auction the property to recover its loan amount.

In this distressing situation, the remaining co-owner, Eve, was unable to intervene and halt the property's auction because there was no prior agreement or arrangement concerning this matter.

Ultimately, the property was sold to settle the outstanding loan, leaving Eve with no recourse to prevent the execution sale due to the absence of a mutual agreement regarding such circumstances.

C.) As the individual owner of the residence, Adam or Eve holds the authority to decide on the property's disposal independently.

However, if Adam and Eve decide to become joint owners, they will have to reach a mutual agreement on the terms of sale for the property. In this scenario, both parties must be in accord regarding any decision to sell the property. If one of them desires to sell, but the other opposes the idea, they will face a deadlock, and the property cannot be sold or transacted.

Therefore, if Adam and Eve are comfortable with jointly making decisions about the property, they can explore the option of purchasing it together as joint owners, understanding that all future decisions regarding the property's sale or any other matters must be mutually agreed upon.

D.) In the case of Adam and Eve, who are joint home loan owners, if they find themselves parting ways, there are three main paths they can take to resolve the situation:

-

Sell The Property On Agreed Terms: The most straightforward option involves selling the house and splitting the proceeds between Adam and Eve. This approach allows both parties to receive a fair share of the financial returns from the property's sale.

-

Purchase Your Partner's Share: In this route, one of them decides to bear the entire financial responsibility of the home loan by buying out the other's share. However, this can lead to financial challenges and will require the approval of the bank since the loan agreement may need to be revised.

-

Agree On Shared Ownership: Alternatively, Adam or Eve can choose to remain in the property, while the other partner still holds a financial stake in the property's value. This arrangement involves ongoing financial obligations for the departing partner, who might choose to sell a part-share of their stake to the remaining party, allowing them to have majority ownership. Such an arrangement requires maintaining a positive and cooperative relationship, which can be challenging to manage.

E.) In the unfortunate event of Adam's passing, the ownership of the property becomes a crucial matter to be addressed. If Adam is the sole owner of the residence and has designated Eve as the beneficiary in his will, the property transfer can only occur once the outstanding mortgage is fully settled.

Let's assume that at the time of Adam's death, there is an outstanding mortgage of RM 250,000 on the property. Before the property can be transferred to Eve as per Adam's will, the debt must be completely paid off.

To ensure a smooth transfer of ownership and avoid complications, it is essential for Eve to settle the outstanding mortgage amount promptly. Once the mortgage is fully cleared, the property can then be transferred to Eve, as specified in Adam's will. This process ensures that the property can be rightfully passed on to Eve, in accordance with Adam's wishes.

1U Note: Did Adam apply for an MRTA or MLTA ? With a home loan insurance, this can enable a tremendous relief for Eve's part on settling the remainder of the home loan. Also, if Adam and Eve are co-owners of this property, they should get their wills written and leave their stake in the residence to each other if one of the parties passes away unexpectedly.

Consider Your Decision

Undoubtedly, the idea of a joint home purchase with your best friend forever (BFF) or significant other (SO) holds great appeal. The prospect of embarking on this exciting journey together, pooling resources, and sharing the joy of homeownership is certainly alluring. However, as with any major decision, it is crucial to approach it with caution and careful consideration.

Remember, buying a home is not just a financial commitment but an emotional investment as well. While sharing this experience with your BFF or SO can be delightful, it also means navigating potential challenges together. From agreeing on property choices to handling financial responsibilities, it requires open communication and a shared vision for the future.

So, before you take the leap, sit down with your partner and have those candid conversations. Discuss financial boundaries, future plans, and how you both envision this journey unfolding. Humorously, you might even want to playfully argue about whose decorating style takes the lead or who gets the bigger closet space !

In the end, a joint home purchase can be an incredible adventure that strengthens your bond and creates lasting memories. May your new home be filled with love, laughter, and countless cherished moments !